Today, caught by Leticia James with Trump’s sleazy hand in the cookie jar, his attorneys agreed to a deal that would give Knight full control of Trump’s $175 million Schwab account and keep the funds from being siphoned off.

Leave it to Donald Trump to pressure the New York State appellate court to bend the law to reduce his bond from $464 million to $175 million, then attempt a unique scam to avoid submitting a legally enforceable bond, and paying even that reduced amount if he loses his appeal.

Donald Trump’s attempted collateralization scheme was an attempt for him to have access to the $175 million Schwab account liquid assets that were pledged to a bond from Knight Specialty Insurance instead of placing them, as required by law, in a lockbox controlled by the bond holder.

This would have meant that Trump would have the ability to control the account, and to bend the law to potentially use the funds to operate or cover losses on some of his many business entities. If that happened and Trump lost his appeal, which is likely, Knight would have had to have to come up with the $175 million itself. But Knight, as Leticia James has pointed out in her motion to reject the bond, has less than 10% of the surplus capital that is required to back a bond this size.

Think of it as a shell game, with nobody showing up when it comes time to pay out.

Many mainstream media outlets apparently had trouble understanding the hearings outcome and that it was in fact a victory for James and NY state.

Headlines following the decision, like this one from ABC news – Trump avoids challenge to $175M bond in civil fraud case – failed to understand what was at stake and the reason for AG James’ complaint.

Most of these headlines have now been updated, but this coverage is yet another example of the media failing to report accurately on Trump’s ongoing cases. Mistakes like this shape public perception and help Trump sound like a winner, instead of a con man whose newest scam just got busted.

Rachel Scharf tweeted live from the courtroom. She reported that the Attorney General’s lawyer Andrew Amer stated that the problem with the Schwab collateral is that “while the funds are cash today, under the terms of the pledge agreement and control agreement they can be swapped out for less secure collateral like mutual funds.” By forcing Trump to hand control of the Schwab account to Knight Specialty Insurance, the AG got what she needed. Now, if and when Trump’s appeal is rejected, at least that $175 million will be available.

As the financial journalist conned by Donald Trump and the notorious “John Barron” into putting him on the first three Forbes 400 wealth lists, I have known Trump longer than any reporter working today.

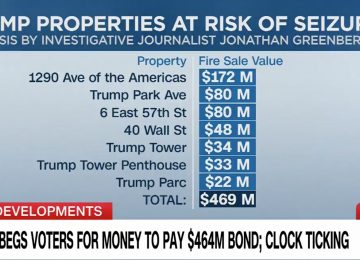

Over the past 40 years, it has become clear that every time that a financial transparency moment arrives for Trump and peels back his lies, what is revealed is a much lower net worth -and far less cash assets- than anyone expects.

That’s because Trump’s properties are heavily leveraged and many of them, despite his fabrications, lose loads of money.

Just three days before the New York State appellate court bent over backwards to reduce his bond by 60%, Trump claimed that he had nearly $500 million in cash in the bank-enough to pay the larger bond himself. But he refused to do it-because it wasn’t “fair.”

When the appellate court decided, inexplicably, to provide Trump with special treatment and reduce the bond amount, Trump stated that he had the money-and might pay it himself. But he didn’t. Instead, he offered up a surety bond so sketchy and unreliable that Attorney General James had no choice but to challenge it.

Why? Because Trump doesn’t have nearly as much cash as he claims to.

First, the $93 million in liquid assets that Trump was forced to pledge to Chubb to get a bonafide bond is locked away until the E. Jean Carroll appeal runs its course.

Then, the money he showed in his Schwab account was probably collected from numerous bank accounts, some of them possibly operating accounts for some of his overly leveraged, money losing properties. So keeping them in a Knight Surety bond lockbox until the appeal is heard and ruled on, at the end of the year, might trigger a cash squeeze.

That’s why he tried to create a complex workaround that would have allowed him to bend the law around his needs.

I have seen Trump’s fake financial statement movie before, as I revealed in a Washington Post article titled, “How Donald Trump silenced the people who could expose his business failures.”

In April 1989, right before his first round of bankruptcies, Trump sent a ridiculously inflated statement of net worth to the Forbes 400 editor which included a signed letter from a senior vice president at Arthur Andersen. The accountant wrote that as of November 30, 1988, Trump had $700 million of cash and liquid assets in his account.

(Read Arthur Andersen’s April 10 letter and response here).

Why did Trump send a letter attesting to a balance five months earlier? Because, unbeknownst to Forbes, $675 million of that $700 million were cash proceeds from a junk bond that Merrill Lynch sold to unlucky investors, with all of the funds earmarked for acquiring and completing the Taj Mahal casino in Atlantic City.

It is impossible to know, at this moment, whether Trump doesn’t have free use of the $175 million in the Schwab account, whether he just doesn’t want to tie it up in a bond, or whether he is determined to get out of paying the fraud case penalty if he loses.

Once again, the most successful con man in history tried to avoid complying with financial regulations that apply to anyone else because compliance is for lesser beings than Donald Trump. Leticia James knows him well. She blew he whistle on it, and his attorneys caved. “Worth a try,” he probably told them earlier in the morning.

Whether Trump scams his way to be a day one dictator and destroys our democracy remains to be seen. Preventing this from happening is the work of my new Stop Trump Dictatorship Project, described in this video: