As the first reporter who, in 1982, tried to derive the truth about the value of Donald Trump’s real estate in the face of his incessant lies, here is my advice for Leticia James’ effort to collect on New York State’s $464 million fraud judgment: Seize and sell the seven least complicated, most valuable in-state properties, and cut Donald Trump out of the deal.

If he does not come up with the cash or a bond by March 25, James should take decisive action and turn the tables on Trump by putting him on the defensive. She should not rely on him, or wait for him, to take any action whatsoever to obey the law.

Instead, James should immediately make good on her stated plan of seizing his assets. This would start with liens and the easy seizure of Trump-related bank accounts, and continue with the legal process of taking control of select New York properties, and then negotiating directly with Trump’s commercial real estate partners to buy out his interests.

Even though Attorney General James has already provided Trump with an extra 30 days to borrow against assets to pay the $464 million judgment (including interest) that he now owes the State of New York, it seems almost certain that Trump will ignore the mandatory March 25 deadline to post the bond necessary to proceed with an appeal.

From that point on, James should expect Trump to not only refuse and contest the legal enforcement of judgment, but also, at every step of the way, the state’s seizure of his assets, the disclosure of documentation to support an asset sale, and anything else that an ordinary defendant is required to do to comply with the law.

Jones must expect that Trump, who has boasted that, after more lawsuits than any business person in history, he has a “PhD in litigation,” is going to fight tooth and nail every single step of the way. His relentless countersuits and refusals to comply with court rulings and business contracts have resulted in more than 3,000 lawsuits. He has become the poster child of a wealthy, vicious litigant evading legal accountability.

Even though Trump has zero legal leverage to stop these asset sales, after a uniquely successful career of legal warfare, he believes that he holds a Trump card that can be effectively played any time he faces accountability. Like his notorious legal mentor Roy Cohn, compliance with the law is for “losers,” not the “killer” that Donald’s father raised him to be.

This is why Trump did not hesitate to deceptively claim, in a deposition for the New York fraud case last April 13 (page 79), that he had “substantially over $400 million in cash.” And then, on February 28, as the time neared to pay his penalty bond, had his lawyers request a “deal” because he could only scratch together $100 million.

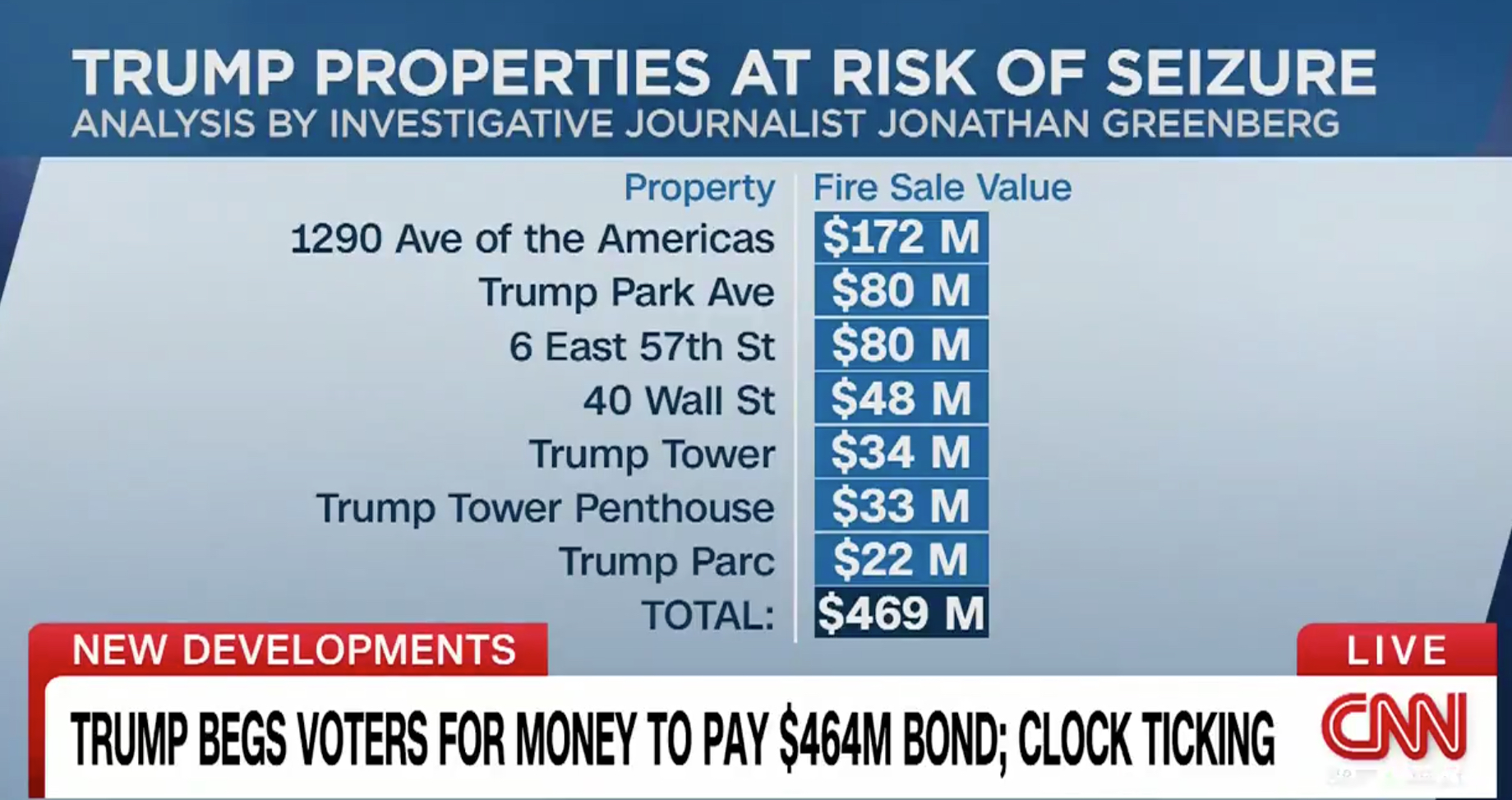

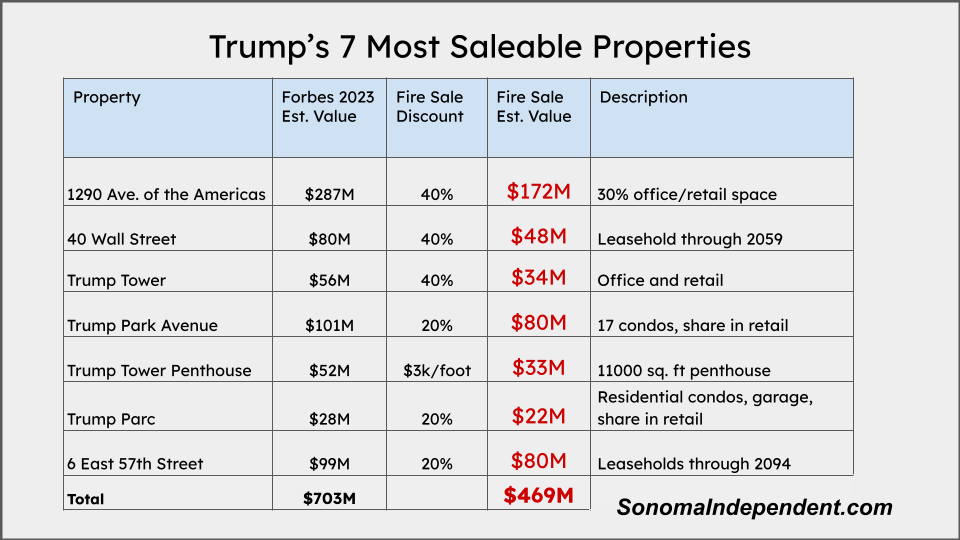

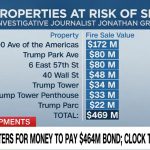

As the person who created the real estate estimates for the first three Forbes 400 rich lists between 1982 and 1984, and the investigative financial reporter who has known Trump the longest, I have created a list (at the bottom of this page) to help Attorney General James identify the most valuable, least complicated, and easily saleable New York properties that, at fire sale prices, could raise a total of $470 million.

The seven properties constitute about 90% of the real estate assets that Trump owns in New York. I have reviewed the Forbes 2023 estimates for the value of Trump’s share of these properties, and significantly discounted their assessments based on four factors.

- This would be a fire sale at the true market price that a buyer is willing to pay quickly, as opposed to the price that Trump, on his own, would hold out for.

- Interest rates are up, office and retail rents are down, and Trump has a long history of overstating the cash flow that he receives from his properties. In order to attract a willing buyer to an unpopular asset class, I have discounted Forbes’ value of his three most valuable commercial properties by 40%, suggesting a bargain basement sales price.

- For the leasehold on the 57th Street former Tiffany building, and the numerous condominiums Trump owns, I have discounted the value by 20% to reflect a fast sale, and a general decline in prices due to higher interest rates.

- For his 11,000 square foot Trump Tower penthouse, I reduced the Forbes estimate from $52 million to $33 million. This is $3,000 a square foot, slightly more than the highest asking price for a comparable large apartment in the same building right now.

For Trump’s three most valuable commercial real estate properties, he is likely weaponize the legal system to obstruct every step in the process, starting with producing property financial statements that any potential buyer would require to even get the process started.

The sale of real estate is always based upon a multiple of a property’s cash flow (profits). Unlike the State of New York and the financial media, only Trump’s real estate partners that share in the bookkeeping of each of his properties knows for certain how much Trump actually makes for his share in each building.

Trump’s real estate partners might be happy to be rid of him-and all the bad publicity his name brings to a landmark New York building. They would not need Trump’s cooperation to determine how much they would pay for his share of the property, and James could offer them whatever bargain was necessary to secure a sales contract.

They are:

1) Vornado Realty Trust at 1290 Avenue of the Americas.

2) Walter J. Hinnenberg, who owns the land leased under 40 Wall Street.

3) GMAC Commercial Mortgage, which owns a majority of the income on Trump Tower, where Trump has a minority participation.

By dealing directly instead of relying on Trump’s compliance with the law, James would put Trump on the defensive for a change, as he tries, unsuccessfully, to stop asset sale negotiations from happening, instead of being compelled to engage in them.

That’s why the Art of the Deal of collecting $464 million from Donald Trump lies in cutting him out of the deal.